The steel price trend has changed!

Entering the second half of March, high-price transactions in the market were still sluggish. Steel futures continued to fall today, approaching the close, and the decline narrowed. The steel rebar futures were significantly weaker than the steel coil futures, and the spot quotations has signs of decline. The first quarter is coming to an end, and steel mills’ orders for the second quarter have been generated one after another. However, from the perspective of terminal purchases, they have not reached the level in same period of peak seasons in previous years. The raw materials price have recently weakened, and the support for finished products has declined.

Steel futures weakened, spot prices fell steadily

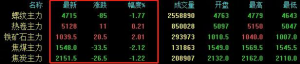

Steel rebar futures fell 85 to close at 4715, steel coil futures rose 11 to close at 5128, iron ore rose 20.5 to close at 1039.5, coking coal fell 33.5 to close at 1548, and coke fell 26.5 to close at 2151.5.

In terms of spot, the transaction was weak, so on-demand procurement, some traders secretly lowered to promote the transaction, and the quotation was partially lowered:

Eleven of the 24 markets for rebar fell by 10-60, and one market rose by 20. The average price of 20mmHRB400E was 4749 CNY/ton, down 13 CNY/ton from the previous trading day;

Nine of the 24 hot coil markets fell 10-30, and 2 markets rose 30-70. The average price of 4.75 hot-rolled coils was 5,085 CNY/ton, down 2 CNY/ton from the previous trading day;

Four of the 24 markets of the medium plate fell by 10-20, and 2 markets rose 20-30. The average price of 14-20mm common medium plate was 5072 CNY/ton, down 1 CNY/ton from the previous trading day。

Excavator sales in March increased about 44% year-on-year

The production and sales of excavators continue to increase. CME expects sales of excavators (including exports) in March 2021 to be about 72,000 units, a year-on-year growth rate of about 45.73%; the export market is expected to sell 5,000 units, a growth rate of 78.7%. As a barometer of infrastructure investment, the sales volume of excavators continues to increase, on the one hand, it reflects the growth of the machinery manufacturing industry that is closely related to the demand for steel; on the other hand, it also reflects the pulling effect of infrastructure investment. With the acceleration of major projects, there is motivation of release continuous demand for steel.

Quotation from steel mill has signs of decline

Incomplete statistics. Today, 10 steel mills out of 21 steel mills adjusted downwards by 10-70, and one steel mill has increased by 180 CNY/ton. This reflects that although steel mills trying to maintain the price, their quotations still have been slightly declined as the raw material ends weaken. , And focus on building materials.

In summary, the current long and short factors are mixed, steel prices continue to be high, market transactions are generally weak, and downstream rigid demand purchases are the main focus. The raw material side has recently weakened, and the support for finished products has declined slightly, the building materials quotations from steel mills has signs of decline. It is expected that steel prices will stabilize and fall tomorrow, and building materials will be weaker than plates.